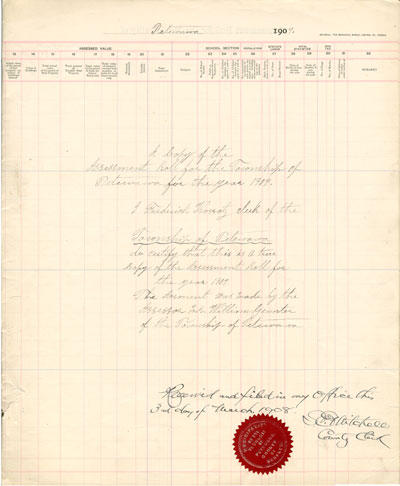

1. Successive No. on Roll,

2. Name and Post Office Address of Taxable Persons

3. Age of every person entered on Roll,

4. British Subject or Alien

5. Owner, Tenant, Far. Son, Far. Dtr., Far. Sis., Husband or Wife, Legislative Franchise

6. Occupation,

7. No. of Concession, name of Street, or other designation of the local division in which land lies,

8. No. of Lots, Houses, etc., in such division,

9. No. of acres or other measure of showing extent of property,

10. No. of Acres of Cleared,

11. No. of Acres of Woodland,

12. No. of Acres of Slash Land,

13. No. of Acres Swamp, Marsh or Waste Land,

14. Actual value of the parcel of real property exclusive of buildings thereon,

15. Value of buildings as determined under sec. 39,

16. Total actual value of the land (14+15),

17. Total Amount of taxable land,

18. Total value of the land if liable for school rates only,

19. Total value of the land exempt from taxation or liable for local improvements only.

20. Business Assessment,

21. TOTAL ASSESSMENT,

22. Religion,

23. School Supporter P. or S./No. of School Section,

24. Total Number of Residents,

25. Male Persons from 21 to 60 years,

26. Date of Births if any during the year

27. Date of deaths if any during the year,

28. No. of dogs,

29. Date of delivery of notice under section 52,

30. Remarks.