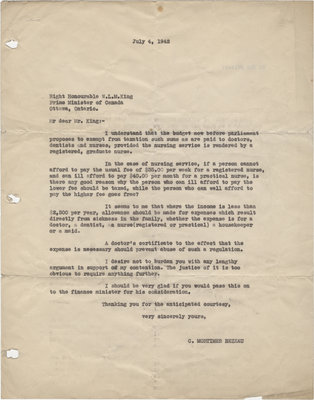

July 4, 1942

Right Honourable W.L.M.King

Prime Minister of Canada

Ottawa, Ontario.

Mr dear Mr. King:-

I understand that the budget now before parliament proposes to exempt from taxation such sums as are paid to doctors, dentists and nurses, provided the nursing service is rendered by a registered, graduate nurse.

In the case of nursing service, if a person cannot afford to pay the usual fee of $35.00 per week for a registered nurse, and can ill afford to pay $40.00 per month for a practical nurse, is there any good reason why the person who can ill afford to pay the lower fee should be taxed, while the person who can well afford to pay the higher fee goes free?

It seems to me that where the income is less than $2,500 per year, allowance should be made for expenses which result directly from sickness in the family, whether the expense is for a doctor, a dentist, a nurse(registered or practical) a housekeeper or a maid.

A doctor's certificate to the effect that the expense is necessary should prevent abuse of such a regulation.

I desire not to burden you with any lengthy argument in support of my contention. The justice of it is too obvious to require anything further.

I should be very glad if you would pass this on to the finance minister for his consideration.

Thanking you for the anticipated courtesy,

very sincerely yours,

C. MORTIMER BEZEAU

(reverso)

To The Editor: